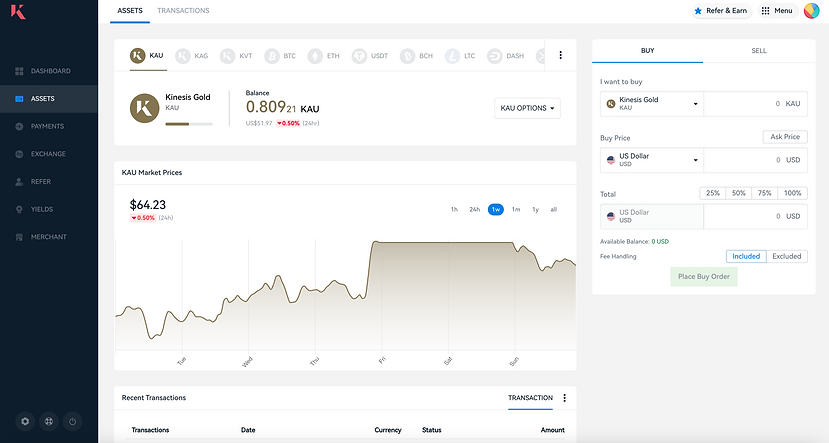

Buy/Sell

Gold, Silver, Crypto

150 Countries

Where else can you

BUY GOLD and SILVER and CRYPTO,

hold it and earn in precious metals for just holding these precious metals?

Open My Free Account

Holding gold and silver is often considered a hedge against the devaluation of the US dollar due to the potential erosion of the currency's purchasing power caused by factors like overprinting by the Federal Reserve. Here's why these precious metals are seen as a hedge:

-

Intrinsic Value: Gold and silver have intrinsic value as precious metals. They are tangible assets that have been valued throughout history for their beauty, rarity, and industrial uses. This intrinsic value can help protect your wealth in times of currency devaluation.

-

Store of Value: Gold and silver have a long history of maintaining their value over time. Unlike paper currencies, which can depreciate due to inflation, economic uncertainty, or government policies, precious metals tend to retain their value.

-

Diversification: Holding gold and silver provides diversification in an investment portfolio. When the value of the US dollar decreases, the value of these precious metals often rises, balancing the impact of currency devaluation on your overall wealth.

-

Hedge Against Inflation: Overprinting of currency can lead to inflation, which erodes the purchasing power of the dollar. Gold and silver historically act as a hedge against inflation because they tend to appreciate in value as the cost of goods and services rises.

-

Safe Haven Assets: During times of economic turmoil, political instability, or financial crises, investors often flock to safe-haven assets like gold and silver. These metals are perceived as a store of value and a source of stability in uncertain times.

-

Historical Evidence: There is a historical track record of gold and silver holding their value and appreciating during times of currency devaluation or financial crises. Investors often look to history as evidence of the effectiveness of these precious metals as hedges.

-

Limited Supply: Gold and silver are finite resources, and their supply cannot be easily increased, unlike fiat currencies, which can be printed at will. This limited supply can contribute to their value retention.

It's important to note that while gold and silver can be effective hedges against currency devaluation, they also come with risks. Their prices can be volatile, and they do not provide income or dividends like other investments.

Additionally, the market for precious metals can be influenced by various factors, including supply and demand, geopolitical events, and investor sentiment.

Investors interested in using gold and silver as a hedge should carefully consider their investment objectives and risk tolerance. It's often recommended to include them as part of a diversified investment portfolio to help protect against currency devaluation and other economic uncertainties.

You should consult with financial advisors and experts in precious metal investments to make informed decisions.